THE U.S. GIG ECONOMY

THE U.S. GIG ECONOMY

The Prophecies … Now Grounded in Facts

At just about this time last year, the Pearson Perspective published an article spotlighting the apparent rise of the gig economy … increasing emphasis by both employers and workers to hire and be hired as independent contractors. Another term often used to describe this burgeoning segment of the workforce is contingent workers.

Contingent workers are best described as all those who are not a direct hire or more specifically are not employees. Another oft-used definition is “A contingent workforce is a provisional group of workers who work for an organization on a non-permanent basis, also known as freelancers, independent professionals, temporary contract workers, independent contractors or consultants.”

While the number of independent contractors and contingent workers was, and is, difficult to quantify, one reliable statistic offered by Intuit reported gig workers to then represent 34 percent of the workforce. Astoundingly, the report further anticipated a significant increase to 43 percent by 2020. Three reasons were proposed to explain what was driving this expected juggernaut of workforce transformation:

- Internet and technology that supports workers functioning remotely from their employer;

- Successes such as Uber and Airbnb called attention to many who had not considered the potential to perform as contingent workers either as their primary occupation or, in current vernacular, as a side-hustle.

- The new tax was expected to accelerate that trend by rewarding workers who convert their status as employees to that of independent contractors. That could mean that sole proprietors, partnerships and S Corporations may deduct 20 percent of their “qualified business income” from their taxable income … meaning only 80 percent would remain taxable.

So the Gig Economy was widely heralded and accepted by many as the wave of the future with significant impact for workers, employers and regulatory bodies. In this article, we’ll look at examples of the predictions and anxiety generated by this foretold upset in the balance of the American workforce. Then read on for the latest findings on this employment phenomenon.

The Predictions

Why I Believe In The Freelance Workstream is the title of an article published in the August 18, 2014 issue of Forbes

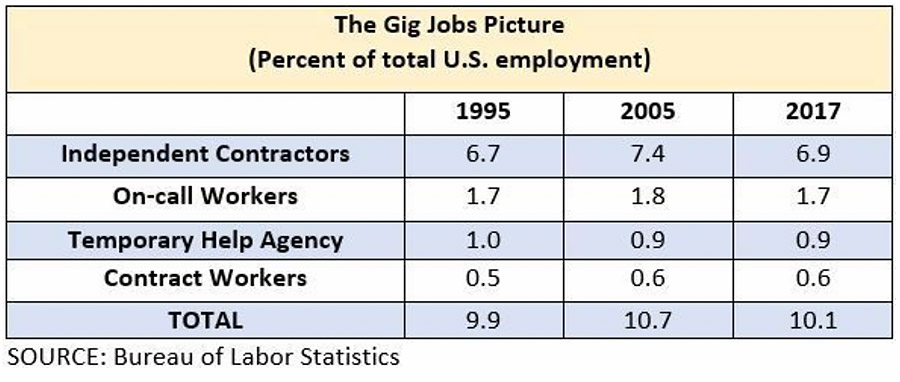

The writers, Jeff Wald and Jeffrey Leventhal, make a strong case for the continued upward trend in freelancers as a percentage of the total U.S. workforce. Freelancers, also known as independent contractors, are estimated to be about 16-20% of the workforce by 2020. In contrast, that number was 6.7% just 15 years ago. Coincidentally, the percentage of full and part-time employees is expected to drop to 82% in 2020, a reduction from 91.9% in 1995.

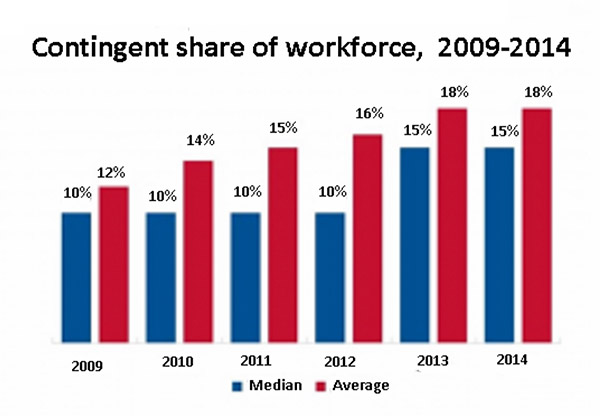

A study by Staffing Industry Analysts bears witness to this reported trend. Here is a graphic representation of their analysis for the 5 years ending in 2014.

The Anxieties

In its acceptance of the generally accepted projections of future growth of the Gig Economy, no less of a government agency than the Department of Labor weighed in and addressed the issue this way:

“As employers seek new ways to make the employment relationship more flexible, they have increasingly relied on a variety of arrangements popularly known as “contingent work.” The use of independent contractors and part-time, temporary, seasonal, and leased workers has expanded tremendously in recent years. The Commission views this change both as a healthy development and a cause for concern.”

Employers were and continue to be urged to recognize there is risk in four key areas when using freelance talent:

- Risk with the Department of Labor and the IRS over whether these workers can truly be classified as independent contractors – both of these agencies would prefer to see all workers as “employees” even if part-time or temporary. The payment of payroll taxes by the employer is an obvious concern.

- Risk of injury – who holds the workers’ compensation coverage obligation? Who holds the risk? The Virginia Workers Compensation Commission will attribute the claim against the business owner in the absence of other coverage and employers may find that their supposed “contractors” are assigned to them by the Commission as employees. Employers should review the Commission’s explanation.

- Risk of Accidents – if damage occurs due to an accident, in the employer’s premises or a customer’s premises, does the freelance worker carry general liability insurance coverage for the claim?

- Risk of illegal use of someone else’s intellectual property – freelance workers comes with a “toolkit” of processes and techniques they apply for the business owner’s benefit. Much of this is “intellectual property”. If that intellectual property actually belongs to a company for whom this freelancer once worked, the business owner may have liability for its use and benefit. This is particularly a challenge for software development, but can surface in many other areas or work.

Note: It’s valuable to draw a distinction between temps and contingent workers. The primary difference is that temp workers are employed by a staffing firm. Contingent workers work directly with an enterprise to perform in the completion of specific assignments. Therein is the potential for risk on the part of businesses or non-profits seeking to use freelance talent.

And Now the Truth

The perception is apparently not supported by reality. Said another way, the supposed radical transformation of the U.S. workforce is not borne out in a recent survey by the Bureau of Labor Statistics (BLS). Take a look at The Gig Jobs Picture in the chart below. As you’ll see, in 2017, the share of workers in so-called gig jobs was 10.1 percent of total employment, almost exactly what it was in 2005 (10.7 percent) and 1995 (9.9 percent).

So what can be anticipated for the future? Hard to say, but for the moment there is an opportunity to step back, take a deep breath and accept that the gig economy has remained remarkably stable. While the past is no guarantee of the future, certainly the trend has remained notably constant.

As ever, we stand ready to help. A phone call or email to Pearson & Co. is all it takes.